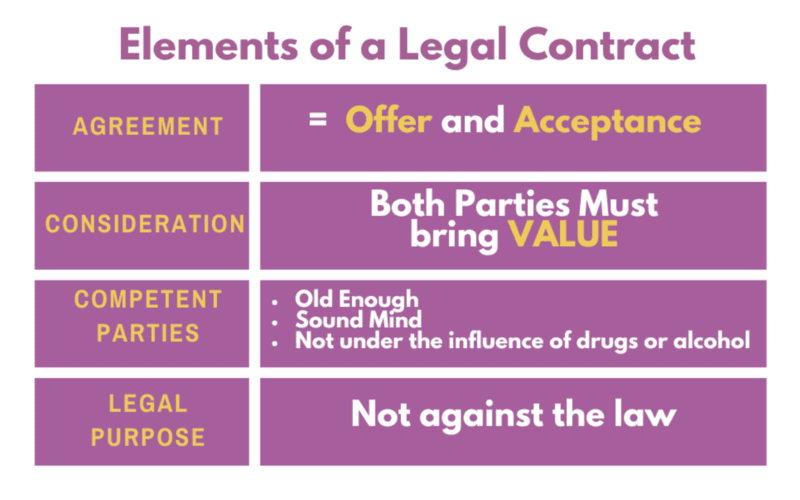

Elements of a Contract

There are four elements that make a contract what it is. You need to understand all four elements.

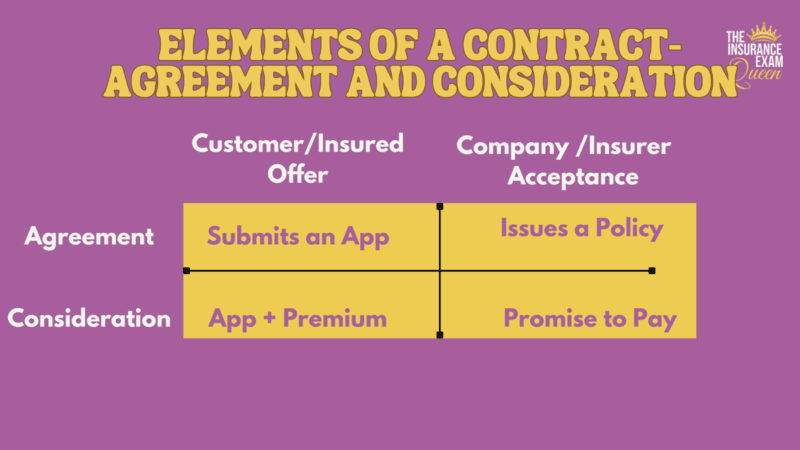

Agreement – First, there needs to be an agreement. An agreement is made when somebody presents an offer, and when somebody accepts it. In the insurance world, the offer is made when an applicant submits an application for insurance. The acceptance is made when the insurance company issues a policy.

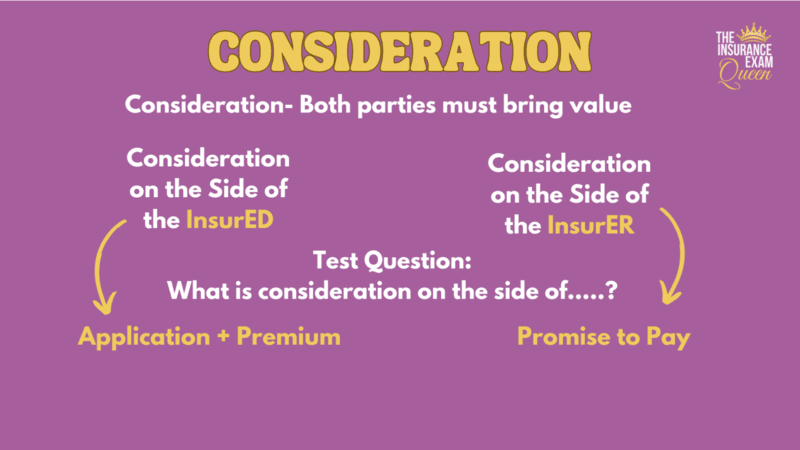

Consideration – Second, for a contract to be valid, there needs to be consideration. Consideration is when both parties, the customer, and the insurance company, bring something of value to each other. The customer is bringing an application, and a premium payment. The insurance company is bringing a promise to pay if a covered Peril were to occur. Consideration on the side of the insured is a premium and an application. Consideration on the side of the insurance company is promising to pay. Consideration tends to be the one that is asked about the most on the test. They want you to understand that consideration means both parties bring something of value, and what that value is for each party.

Competent Parties – Third, the customer needs to be a competent party to agree to the contract. When I think about competent parties, I think about what I need to say whenever I am going to get a tattoo. I need to sign a paper that says I am old enough, I know what I’m doing, and I am not under the influence of drugs and alcohol. That creates a competent party, somebody who can get into an agreement to purchase an insurance contract. If you see a question that lists out four different people who are taking drugs, and they want to know which one the competent party is, just think common sense. If they are talking about recreational drugs, or alcohol, they are not a competent party. If they are talking about someone who is following a prescribed drug plan by a doctor, and it is a common normal medication, then they would be a competent party. However, if they just had surgery, and are on pain meds that is not a normal/regular medication, and they would not be a competent party.

Legal Purpose – Lastly, there needs to be a legal purpose for a contract to be valid. This just means that the contract cannot break the law, and it cannot be hurting anybody. Think Joe Exotic and Carole Baskins for this one!

Now who sells these insurance contracts- You! You are going to be the Agent, so let’s look at your relationship with the insurance company!

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about P&C GOLD Learn more about L&H GOLD

Share the Post

Click to share the post to your network