7 Pay Test MEC

For purposes of the exam there are a couple of important things to keep in mind.

You don’t need to know how to do the “7 pay Test” and you really don’t even need to know what it is … you just need to know:

- There is something called a “7 pay Test”

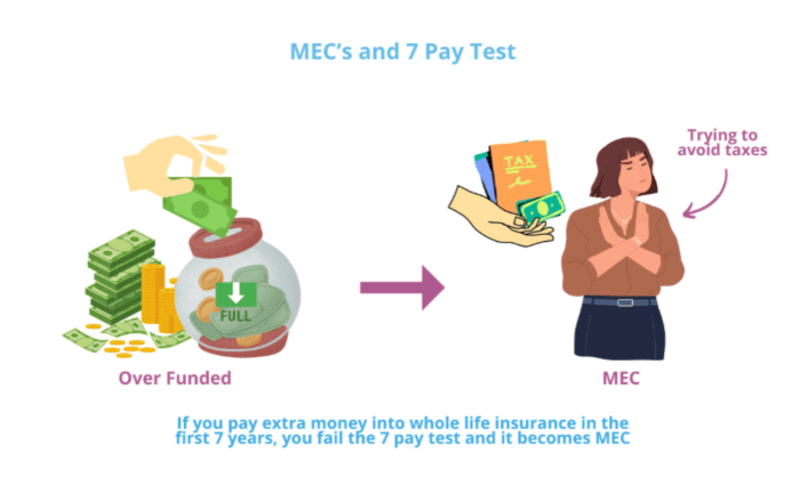

- This “7 pay test” is what decides if a policy is best described as a “Life insurance policy” OR if the policy should be called a “Modified Endowment Contract”.

- Once a life insurance policy is deemed a “Modified Endowment Contract” it loses the favorable treatment given life insurance policies AND that MEC can never be turned back into a life insurance policy.

That is really all you need to know.

Remember: Life insurance policies are very special because it is a way to provide for and pass wealth to beneficiaries untaxed and without going through probate. Life insurance is very unique in that way and the IRS allows this in part because of all the good Life insurance can do for society (if people are poor because a bread winner died or become homeless because someone died and their house was foreclosed on, many of those people may turn to government assistance).

There are some wealthy people however who can game the system and shove a bunch of upfront money in their Life insurance policy’s cash value as a way to avoid taxes. In its simplest form this “7 Pay Test” is how the government and accountants make the decision if a policy is truly a life insurance policy and gets all the special tax treatment given to Life policies OR if someone was buying the life insurance policy with the primary objective of avoiding or delaying taxation on income.

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about L&H GOLD

Share the Post

Click to share the post to your network