Elimination Period & Probationary Period

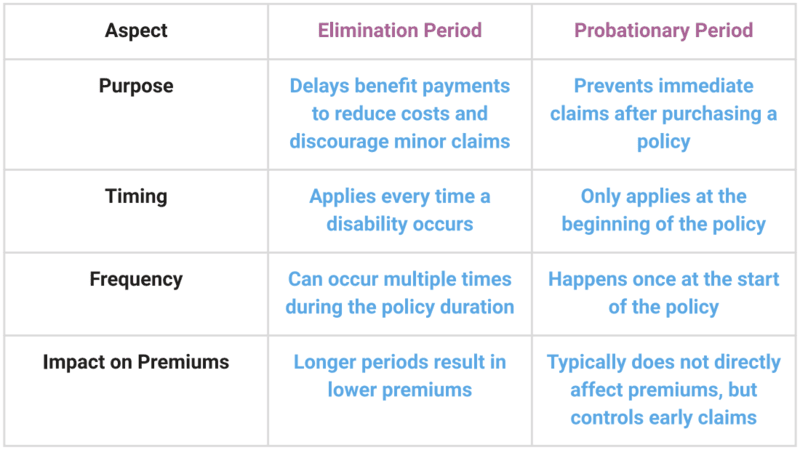

An elimination period is the number of days between an event and when a benefit happens. The most typical example is Disability insurance. Pretend I come into your office to buy disability insurance. You say, “Pat I have two different disability plans I can offer you. One is my platinum “Super Will” plan. Heaven forbid you fall out of a tree and become disabled, but it only has an 8 day elimination period. That means that if you become disabled and are not able to return to work within 8 days it will start paying you a monthly benefit to help make up for your lost employment income. I call it the Super Will plan because Will you invest in this platinum plan … and the S in Super kind of reminds me of the 8 for the 8 day elimination period. This is our richest plan, and it costs $100 a month.”

Pat – “Ummm, my health insurance is $300, I can’t spend another $100 on the off chance I fall out of a tree”

You – ” That’s why I have a second plan for you. It pays the exact same benefits as the other plan. The reason it is less expensive is because the elimination period is 6 months. You have a much better chance of recovering from a disability in 6 months than in 8 days. Most people are back to work in a couple of months. This plan is only $15 a month.”

NOTE: sometimes on the test they talk about Elimination Period sort of being like a time based deductible. The higher a deductible, the lower the premium .. all other things equal. Likewise the longer the E.P. the lower the premium .. all other things equal.

The probationary period is the time during which a claim would not be paid. For example a cancer policy might have a probationary period. People see a funny purple growth on their elbow, their uncle had the same thing and it was cancer … they go buy a cancer policy the day before their scheduled doctor’s visit. Maybe the cancer policy has a 90 day probationary period, anything diagnosed within the first 90 days would not be a covered claim. Probation periods are only at the beginning of the policy and once its done that’s it. The elimination period only begins when a disability begins, so it can happen anytime that happens and it can happen many times in the policy.

Presumptive & Recurrent

Presumptive:

We have Any vs Own policies which determine if a person can collect a disability check based on if they can work either their own job or any job. If presumptive disability is on the policy, it supersedes the rules of any vs own and says that a person is considered disabled upon the permanent loss of any 2 limbs, eye sight, hearing, or speech. Usually, this will last for about two years and then any or own will kick in based on what policy you have.

Key word – PERMANENT and TWO. In order for presumptive to pay you have to permanently lose TWO limbs, TWO eyes (blindness), TWO ears (hearing) or speech – Coverage is for TWO years.

Recurrent:

Imagine you have a disability that comes and goes. You have an episode that requires bedrest, you cannot work so you file a claim for disability. You wait your 30 day elimination period and you finally get a check for lost wages. A month later you’re feeling better and you go back to work. You’re able to work for a few months, but then you’re back to bed rest. If this is the cycle of your disability, every time a new episode hits, you have a new elimination period and so you end up missing a lot of wages. You find that it’s not in your best interest to get better and so you linger in your disability and do not go back to work. Well, insurance companies would rather you go back to work even for just a few months so they don’t have to pay, so they came up with recurrent disability. Recurrent says if your disability comes and goes, as long as it comes and goes within a certain amount of time, usually somewhere to 3 to 6 months, they will count any additional episode as a continuation of disability. This means I can go back to work and when the episodes hit again, I will just start collecting my disability and not have to have a whole new 30 day elimination period.

Partial Vs. Residual Disability Income

Both Partial and Residual are set up to pay when you cannot work as much as you did before. Let’s say you would work 5 days before and now you can only work 3. You made $100 a day. So pre-disability you made $500. Now you’re only making $300.

Partial will pay you for half the TIME you’re missing. Partial focuses on time. If you have partial, you would expect a $100 check from your insurance for each week that you’re only working the reduced time.

Residual will pay all of what your missing, the difference between prior and current earnings. Meaning you will get a $200 check from the insurance. Residual focuses on EARNINGS. Residual is beginning to be the new standard from policies and partial is slowly going away.

Key Person Life Insurance

The easiest way to think about key person insurance, is that a business is buying insurance on the CEO. If the CEO of a large company were to suddenly pass away, or to become disabled the company would need to quickly hire and train someone else to fill the position. By having a key person insurance policy, the business is able to have the money that they need to quickly recruit, hire, and train the new CEO. Key person does not have to be on a CEO, it can be on any employee who is key to the business. If you have a software company, and there is a one developer on your team who understands the system inside and out, and no one else quite understands it as fully as they do, they are a key person to the business. You might want to purchase key person Insurance on your developer. This way you can have money needed to find and replace your key person if they die or become disabled.

What’s also really important to understand is that this is a policy that was started by the business, paid for by the business, owned by the business, and the business is a beneficiary. The key person only gives their consent to have a policy written on them, but they are not involved in paying for the policy, benefiting from the policy, nothing.

Buy-Sell Agreement

A buy-sell agreement is when there are two or more people who have started a business together. Each partner buys insurance on each other just in case one of them dies or becomes disabled. This allows the still alive business owner who has not died or become disabled to keep the business going.

Drawing this out on the power-point will be the best way to teach this.

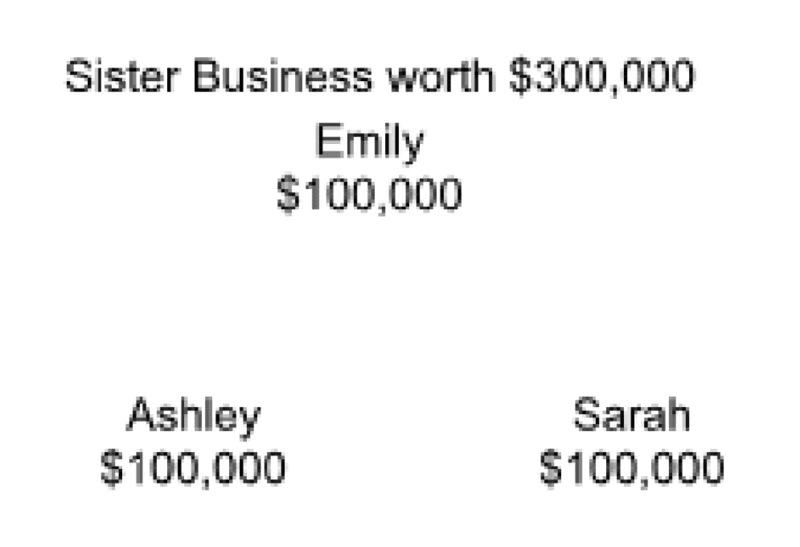

Imagine a scenario of a sister business. Each of the three sisters invested $100,000 into the business.

Draw this:

The business purchased a building, equipment, created their inventory to sell etc. The $300,000 is not sitting in a bank account, it’s been spent on all those things. If Sarah died/becomes disabled, her immediate family will want that $100,000 back. The sisters would have to liquidate the inventory, sell the building, etc. and they probably won’t get all $300,000 back to get Sarah her $100,000. By both Emily and Ashley having insurance on Sara, it can solve this dilemma

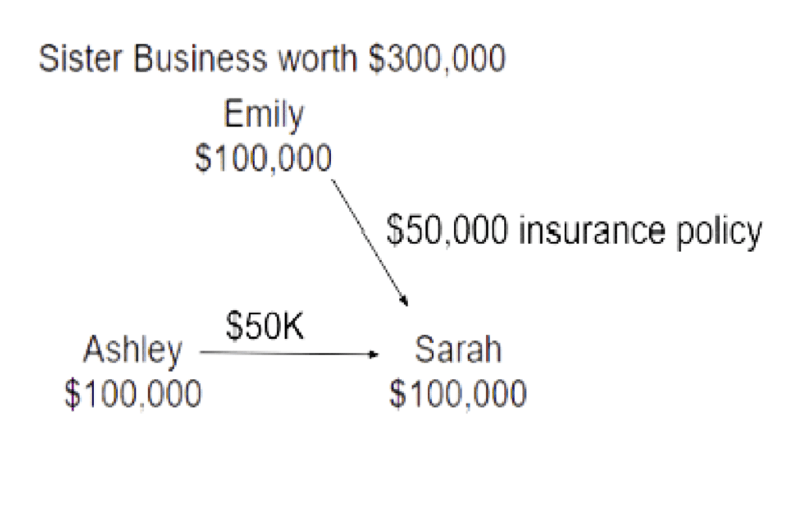

Add these arrows and #’s:

The other sisters though will want to keep the business going. By having the insurance Ashley will get $50,000 to buy half of Sarah’s share of the business as will Emily and Sarah’s immediate family will get the $100,000. Now, the other sisters will now be 1⁄2 owner instead of 1⁄3 owner.

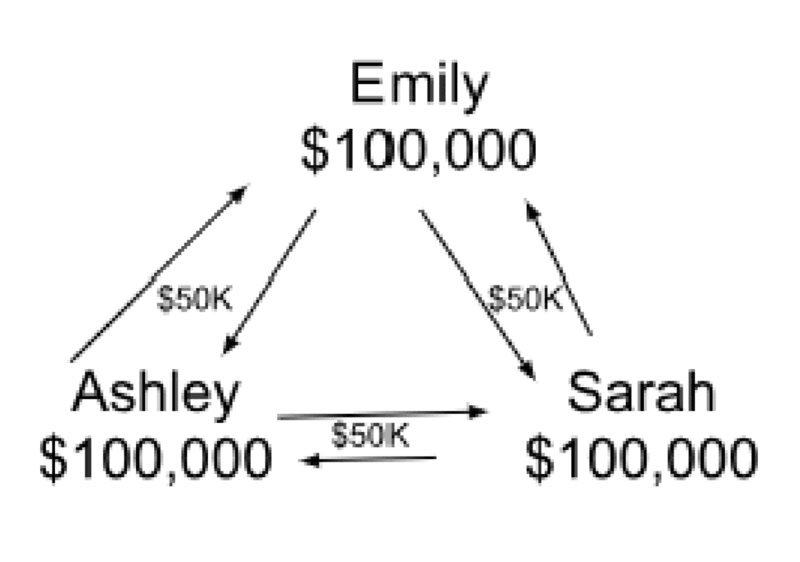

But, do we know that Sarah will be the one that is disabled? No, so what actually needs to happen is that Ashley will also buy a $50K policy on Emily, Emily will buy a 50K policy on Ashley and Sarah will buy a $50K policy on both Emily and Ashley too:

Add this:

So before anyone dies or becomes disabled, this is what the Buy Sell Agreement would look like, they all buy insurance on each other so they can sell their share if they die/become disabled.

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about L&H GOLD

Share the Post

Click to share the post to your network