Hazard Vs Peril

Let’s talk about how the risk can lead to a loss that insurance companies will cover.

A Hazard is something that will increase the chance of a loss, and there are three types: Physical, Moral and Morale.

Physical

The easiest is physical, you can see and touch it. A tree branch sticking out of the sidewalk is a

physical hazard, you can trip on it and get injured. A can of gas next to rags in the garage is a hazard it could lead to a fire.

Moral

Moral is a hazard where a person makes a choice to lie/do wrong. They know what they are doing is wrong and they do it anyway. This would be like an applicant lying on their insurance application.

Morale

Morale is a sense of carelessness. I like to think of teenagers. Sometimes teenagers do something because they don’t understand the dangers and sometimes, they do something because they think they will live forever and aren’t afraid. They just don’t care. Either way, it’s a Morale Hazard and can increase the chance of a loss. In insurance, this looks like, “I want to speed, so I will. And if I crash, insurance will cover it anyway!” or “I leave my door unlocked all the time, and if someone steals my stuff, I don’t care, insurance will cover it”.

No matter which type a hazard is- something that will increase the chance of a peril happening.

Peril

A peril is the CAUSE of loss, the events that happen that lead to the destruction of property/bodily injury. Perils are the things you either are or not covered for.

- It’s like this: the rags and gas can are a hazard, and it’s likely a fire will occur. The fire is the peril.

- The tree branch makes one more likely to trip, the branch is the hazard. Tripping on the branch(injury) is the peril.

- The chair that fell out of a truck and it now sitting on the highway is a physical hazard, hitting it with your car(collision) is the peril.

- Perils are the cause of loss- and loss is the decrease or disappearance of value. When we file a claim, we are asking the insurance company to pay for the loss.

Insurance companies determine if they cover the peril depending on the policy.

Named Peril vs Open Peril

A peril is the CAUSE of loss, the events that happen that lead to the destruction of property/bodily injury. Perils are the things you either are or are not covered for.

For property insurance, you can either purchase a “named peril” policy or an “open peril” policy.

A named peril policy says “only this is covered.” It’s a policy with a list of perils that you are covered for. Essentially, in order for it to be covered it must be named. One memory trick for a named peril policy, is that “if it ain’t named, it ain’t covered.”

An open peril policy says, “anything BUT this is covered.” It’s the opposite of a name peril policy, instead of saying what is covered, it says what is not covered. An open peril policy is a policy of exclusions. Everything is covered unless it’s excluded. Sometimes an open peril policy is called “all risk.”

An open peril policy is easy, because it’s almost like a one size fits all. It covers everything not

excluded, so they name open peril policies as Special and Comprehensive.

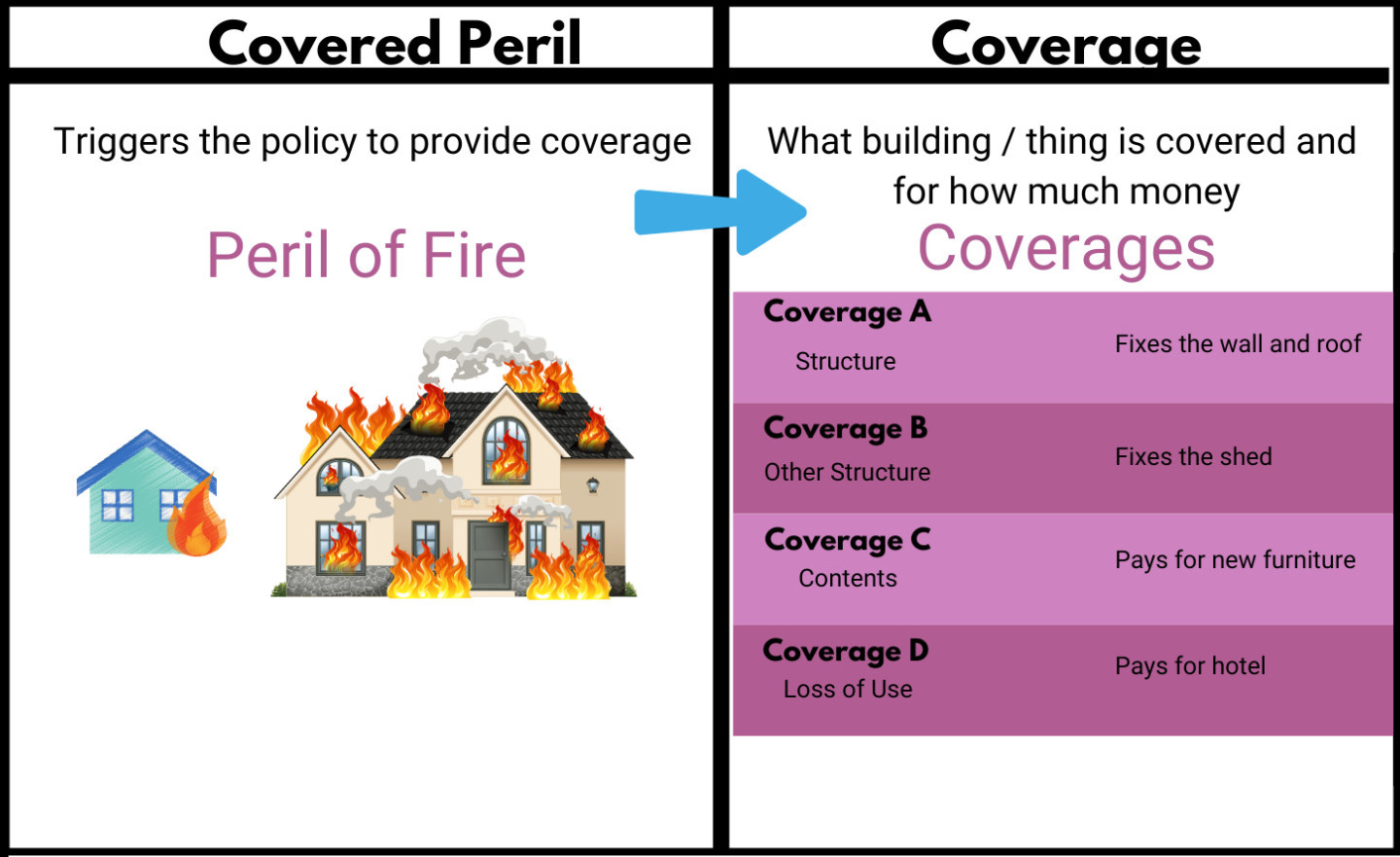

Keep in mind, there is a difference between a “covered peril” and “coverage.”

A Covered Peril is what triggers a policy to provide coverage.

Fire, which is always covered, would trigger the policy to provide coverage. The peril of flood, which is always excluded, would NOT trigger the policy to provide coverage.

Coverages describe two things-what building/thing is covered and for how much money.

Let’s Recap again!

Hazards, whether Physical (material and structural), Moral (lying) or Morale (carelessness), are things that increase the chance of loss. Loss is the decrease or disappearance of value. We can losses based on perils. Perils are the cause of loss like fire, wind or hail. You can buy either an Open Per Policy that covers everything not excluded or a Named Peril Policy that only covers the specific perils.

So how do we get insurance so they can cover our risk and pay for their losses? We need to make an offer to them! When we fill out an application with the insurance company, we are offering them orisks. If they accept them, they will issue a policy for us.

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about P&C GOLD Learn more about L&H GOLD

Share the Post

Click to share the post to your network