Disability Income Tax

Taxes feel complex, but it doesn’t have to be. Taking what you already know and applying it in a different way will help you master this chapter.

First, consider how do you pay your car insurance? You pay it from your pay check. What happened to your pay check before you got the money? Taxes were taken out. Thus, we can say the money that paid the premium has already been taxed. This is one thing you knew without realizing it, that money you use to pay for insurance premiums is money that has already been taxed.

Consider further, if you were to crash your car and get a check from the insurance company for the value of your car, do you need to report that as income to the government on your taxes? No, you do not, all the benefits are tax free. For car insurance, we paid premiums with money that was already taxed and thus when we get the benefit, it’s tax free.

Taxes need to be paid only once and we deal with insurance money twice, the premium and the benefit. One of those things, premium or benefit will need to be taxed. So which one, and why?

You purchase car insurance as an individual, and individuals buy all their insurance with money that has already been taxed. Meaning, individuals always pay for insurance with already taxed money. Thus, we can safely say that if an individual purchased insurance, the premium paid was already taxed, so when an individual gets a benefit, it’s tax free.

Who then does not buy insurance with money that has already been taxed? Employers! Employers often pay some or all of the premium of our group insurance. When an employer does that, the government allows the business to tax deduct the cost as a business expense. Tax deductible means a tax write off, which means, no taxes are paid. Therefore, when an employer pays the premium, the money has not been taxed, meaning any benefit received from the insurance is taxed.

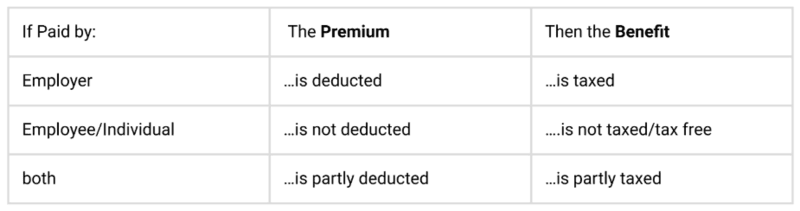

In short:

An individual pays the insurance premium with already taxed money, and the benefit an individual receives is tax free.

An employer pays the premium with money that has not been taxed, and the benefit paid to the employee will be taxed.

What happens then when the premium is shared between the employer and the individual/employee? The premium is partly paid with taxed money and partly not, thus the benefit will be partly taxed and partly not.

Here is an example:

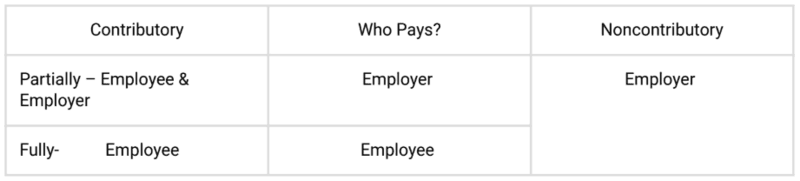

An employee has a group disability policy. The premium is $100 a month. His employer pays $70 of that premium and the employee pays the remaining $30. The benefit amount is $1000 a month. What will happen to the benefit when it pays out to the employee?

Well, if the premium is $100, and the employee paid $30, that means he paid 30% of the premium and the employer paid $70 which is 70% of the premium. Now we need to apply that to the benefit. 30% of the $1000 benefit is $300 and 70% of the $1000 is $700. Since the 30%/$300 is connected to the premium paid by the individual employee, that benefit is tax free. The 70%/$700 is connected to the premium paid by the employer, that portion will be taxed. When the check pays out, $300 is tax fee, $700 will be taxed.

We can take this a step further. Imagine this is the situation:

An employee has a group disability policy. The premium is $100 a month. His employer pays $30 of that premium and the employer pays the remaining $70. The benefit amount is $1000 a month. The policy has a 30-day elimination period. How much money will be paid to the employee if he is disabled for 7 months, and what will happen to the money?

We already know the last part of the question which is 70% will be taxed! If the insured is disabled for 7 months, but has a 30 day elimination, this means that he will only be collecting for 6 months. Six months at $1,000 a month is $6,000. Our final answer is, the insured will be paid $6,000 and 70% of it will be taxed.

Business Disability Tax

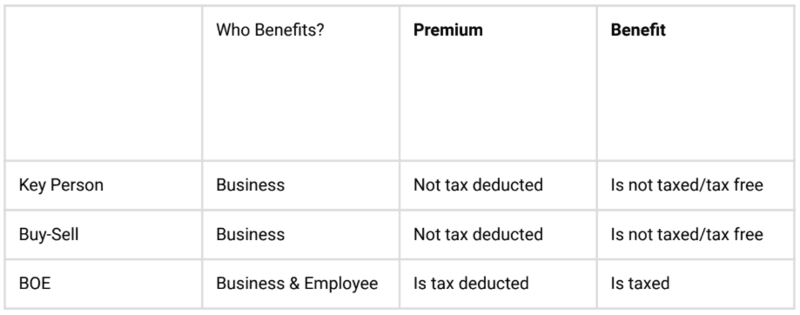

Pulling from what we discussed earlier, “When an employer does that (pays premium for its employees), the government allows the business to tax deduct the cost as a business expense.” We can jump to the conclusion then that the government likes when employers benefit employees and will let them tax deduct premiums when the premiums are benefiting employees.

We have three business disability policies, Key Person, Disability Buy-Sell and Business Overhead Expense (BOE), which ones benefit employees directly? Only one and they make it easy on us, the BOE does, and we can even give ourselves a memory trick of Business Over Head is BOE is Benefit Of Employees! That means only the premium for the BOE can be tax deducted. Tax deducted means write off, means no taxes are paid. Therefore, if BOE premium is tax deductible, the benefit is taxed.

Key Person and Disability Buy-Sell are not directly benefiting employees, that means the premiums are not tax deducted, which means the premium is paid with money that has already been taxed. If the premium were paid with already taxed dollars, the benefit is therefore tax free/not taxed.

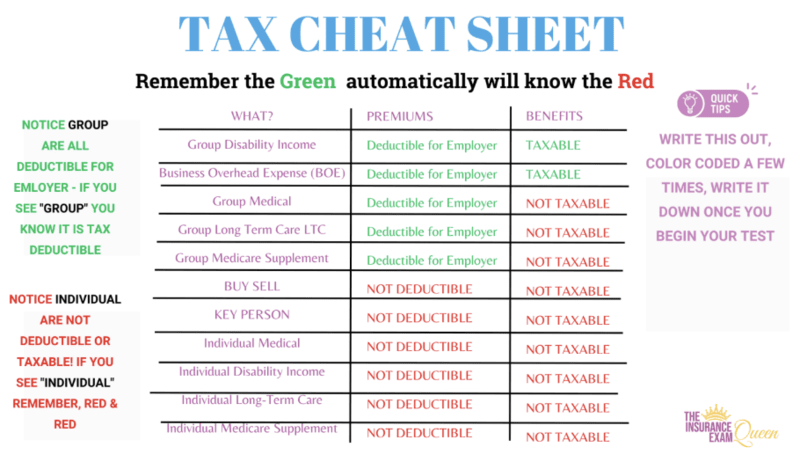

Tax Charts

Disability Income

Business Disability Income

Tax Cheat Sheet

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about L&H GOLD

Share the Post

Click to share the post to your network