Buy-Sell Agreement

A buy-sell agreement is when there are two or more people who have started a business together. Each partner buys insurance on each other just in case one of them dies or becomes disabled. This allows the still alive business owner who has not died or become disabled to keep the business going.

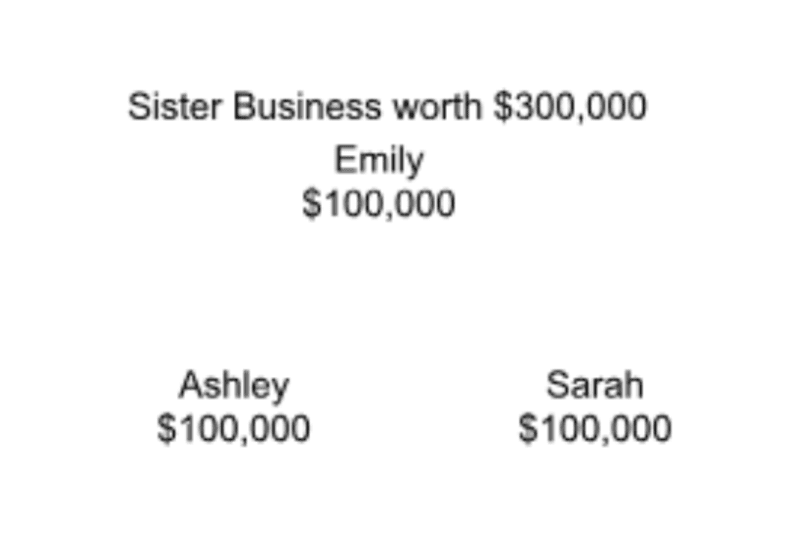

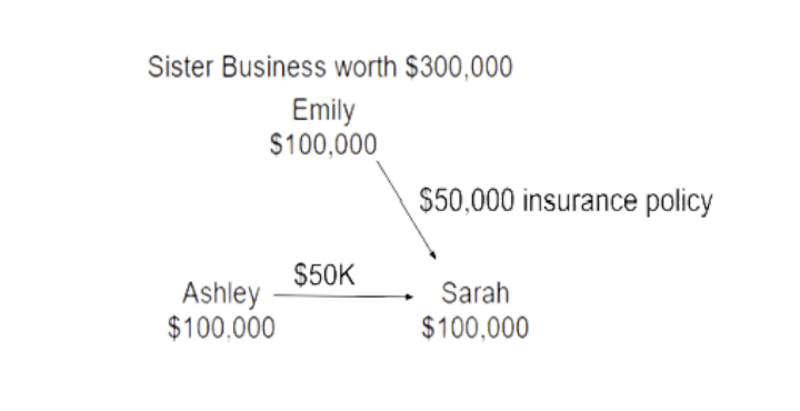

Imagine a scenario of a sister business. Each of the three sisters invested $100,000 into the business.

Draw this:

The business purchased a building, equipment, created their inventory to sell etc. The $300,000 is not sitting in a bank account, it’s been spent on all those things. If Sarah died/becomes disabled, her immediate family will want that $100,000 back.

The sisters would have to liquidate the inventory, sell the building, etc. and they probably won’t get all $300,000 back to get Sarah her $100,000. By both Emily and Ashley having insurance on Sara, it can solve this dilemma.

Add these arrows and #’s:

The other sisters though will want to keep the business going. By having the insurance Ashley will get $50,000 to buy half of Sarah’s share of the business as will Emily and Sarah’s immediate family will get the $100,000. Now, the other sisters will now be 1⁄2 owner instead of 1⁄3 owner.

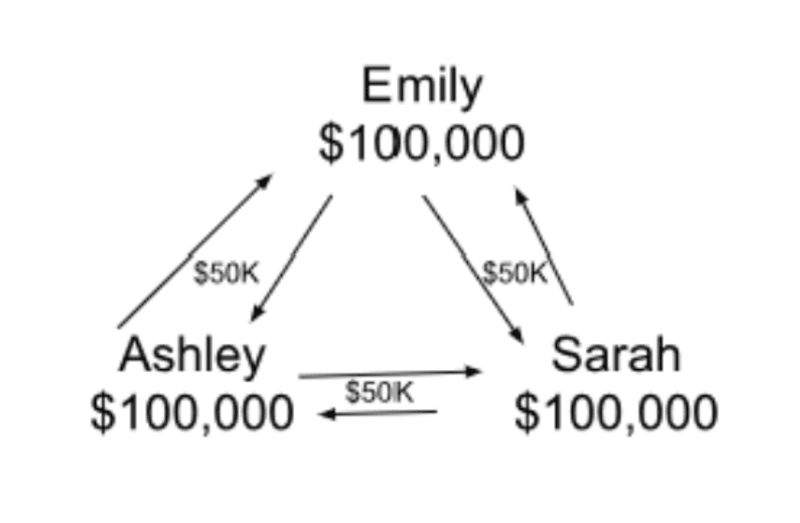

But, do we know that Sarah will be the one that is disabled? No, so what actually needs to happen is that Ashley will also buy a $50K policy on Emily, Emily will buy a 50K policy on Ashley and Sarah will buy a $50K policy on both Emily and Ashley too.

Add this:

So before anyone dies or becomes disabled, this is what the Buy Sell Agreement would look like, they all buy insurance on each other so they can sell their share if they die/become disabled.

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about L&H GOLD

Share the Post

Click to share the post to your network