Certificate of Authority

When an insurance company is ready to sell in a state, they will go to the Department of Insurance in that state and ask “can we sell here?” If the department of insurance is okay with that company selling in that state, they will provide them with a Certificate of Authority.

A Certificate of Authority allows an insurance company to operate within that state. If a company has a Certificate of Authority, they are known as authorized and/or admitted. It’s important to note that companies are not considered certified, a Certificate of Authority merely says that they are authorized/admitted.

One thing to note is that “Surplus Lines” are the exception. Since they are willing to sell difficult or hard to place insurance, they get a pass. They do not need to get a certificate to sell so we call them “nonadmitted”

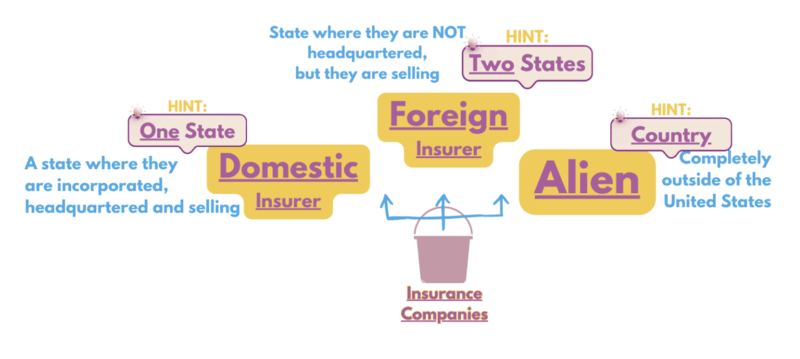

Insurance companies can be categorized according to where they are located and selling.

Domestic – When we say that an insurance company is domestic, we are saying that they started in this state, are headquartered in this state and selling in this state. The course and the exam will go back and forth between using the words headquartered or incorporated and ultimately, they mean the same thing. Wherever a company is headquartered and selling they are known as domestic. Hint: If the question only mentions ONE state, it’s probably Domestic.

Foreign – is when an insurance company is selling in that state, but they are not headquartered in that state, they are incorporated somewhere else. If an insurance company was headquartered in New York, but they are selling policies in Florida, in Florida they would be known as foreign. Hint: If the question mentions two states, it’s probably foreign.

Alien – means that the insurance company is incorporated/headquartered in another country. Hint: When you see the word country, it’s probably Alien.

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about P&C GOLD Learn more about L&H GOLD

Share the Post

Click to share the post to your network