What is STARR

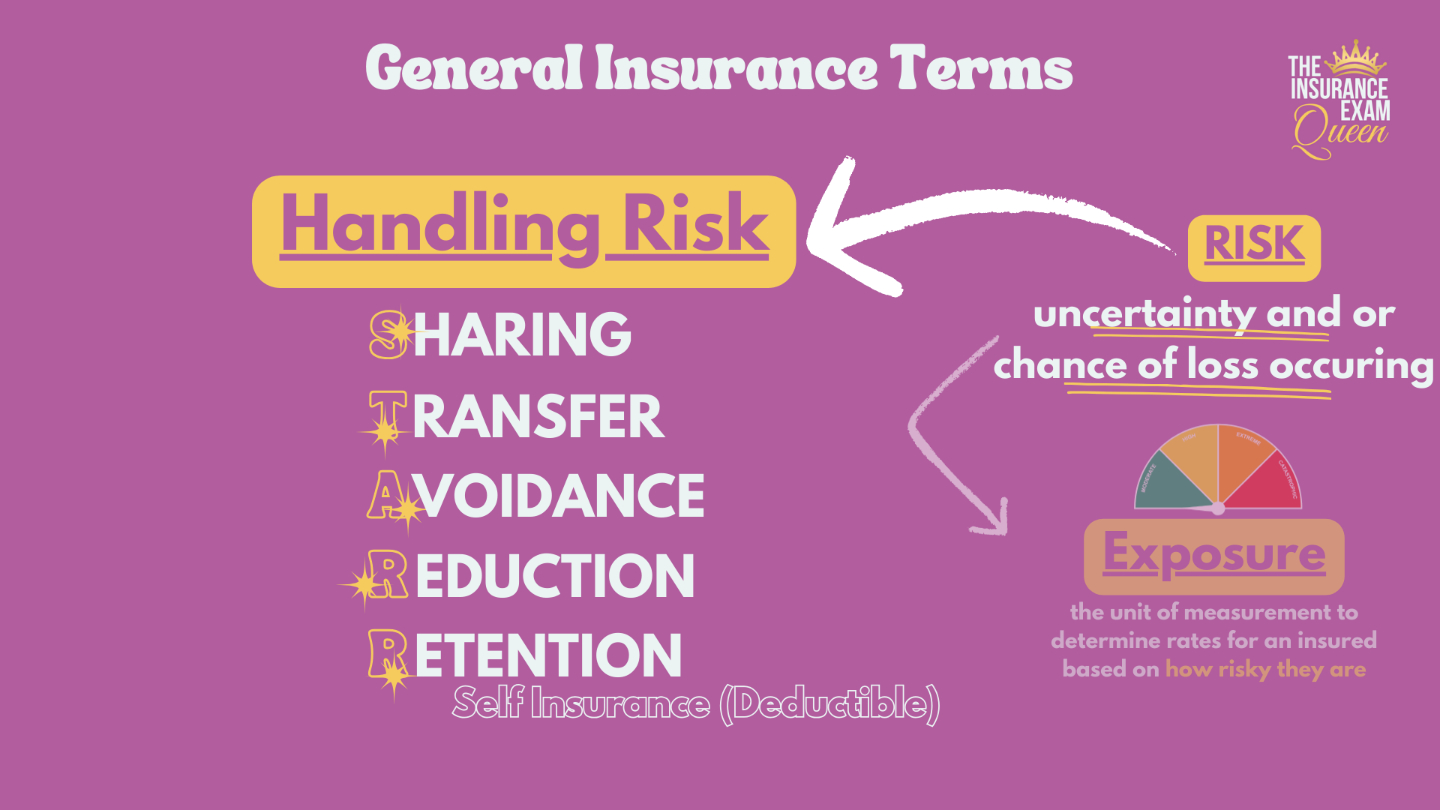

Let’s talk about risk.

Risk is the uncertainty of chance of loss. As we live our lives, we live with the risk that we may crash our car, that our house burns down, that our spouse dies or that we get sick. We lose out if any of these things were to happen.

There are a few methods we can do to handle risk in our lives. I like to say…

“I am a STARR at handling risk”

STARR is an analogy for Sharing, Transfer, Avoidance, Reduction and Retention. Use STARR as a aid to remembering the meaning of the following types of handling risk.

Sharing

Sharing is the idea that people will share the risk among themselves. Think of a group of friends, and one of them is in an accident. All the friends pitch in money to help the friend out. While the online course text means it in a more formal way, it’s not one of the methods we need to know really well anyway.

Transfer

Transfer is the BEST method. Insurance is the transfer of risk!

Avoidance

Avoidance is the most unrealistic option. We can never leave our house, never drive a car, never go outside when it’s snowing, but all of these things are extremely unrealistic. While we avoid what we can, this option is rarely viable.

Reduction

Reduction is a way of reducing our risk. Putting salt on the ice on our sidewalk, making sure tires have enough air for when we drive, eating fruits and veggies to be healthier, choosing to take vitamins to reduce becoming sick, wearing the proper clothes while hiking, these are all ways of reducing the chance that accidents, sickness or injury are to occur.

Retention

Retention, what is a way of retaining/keeping some of the risks for ourselves. Just like a retaining wall holds back water, we are holding back some of the risk. The way we do that in insurance is by having a deductible. We are retaining that much of the risk. Now there are also risk retention groups.

These are groups of people who basically pool money together and agree to cover each other it’s a way of people ensuring each other and themselves without an insurance company involved, but they do use an attorney to decided who can access the money and when.

So transferring risk is the best ways to handle risk.

Transfer it to someone else, let them deal with it and the “them” is insurance companies!

We aren’t transferring the fire, crash, death or illness to them, but the cost of those things. We crash our car, car insurance gives us the money to fix or replace it. We get sick, medical insurance covers the medical bill. Our spouse dies, life insurance gives us a chunk of the income they would have earned if still alive.

Of course, insurance companies cannot cover all risks. Insurance will not cover things that are way too risky(adverse selection) and they cannot cover things like gambling(speculative).

If we gamble (speculative), we can win, and if we insure the loss, we win anyway by using our insurance. Why would insurance want to cover that? They don’t!

We categorize the risk that insurance companies will cover or not by separating them into “Pure Risk” or “Speculative Risk”

Pure Risks are the risks where there is nothing to be gained. My house will either burn down, or it won’t. My spouse will either live or die. I will either crash my car or not. We call Pure Risk, loss or nothing/no chance of gain. Pure risks are insurable.

Risks where we can win or lose, like gambling are NOT insurable and we call them Speculative Risk.

In addition to being “Pure” a risk also has to have a few more components before the insurer will accept the transfer. These are called “Element of an Insurable Risk“.