Joint & Survivorship Life

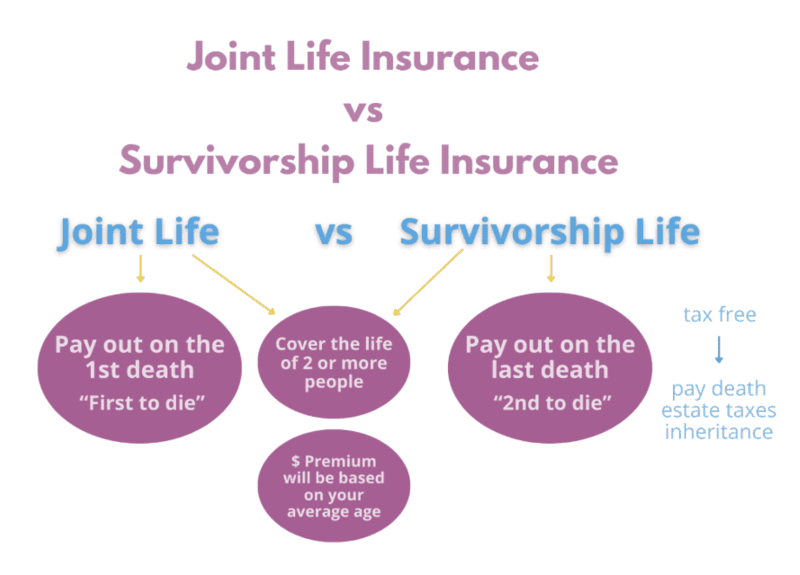

In an effort to save money, or to make things simple, people may purchase life insurance together. When we do this, we are buying joint life insurance policies.

What the insurance company will do is take the average age of both people, and charge of the rate based on that. This is super helpful if one partner happens to be older and may struggle to purchase life insurance on their own.

There are two options when purchasing joint insurance. The first option is to buy what is simply called as joint life insurance. This one will pay out when the first person dies. You may want to purchase this policy if you have a younger family, children that are still in school, and the spouse who is left is going to need that money to take care of the family.

The second option, is called survivorship, or second to die. This option is great for a couple, whose children are already grown up. If one of the spouses were to die, the other spouse would be fine, and they’re mostly looking to leave the money to their children or to pay their estate taxes so they can leave the estate to their kids.

So let’s say the husband dies first, the policy stays intact, and will continue until the wife dies. Once the wife dies, the plan will pay out to their beneficiaries.

Now both of these policies will have a cheaper premium than two separate policies, because we have taken the average age of both lives. But which one do you think would be cheaper over the other?

If joint will pay out on the first death, and survivorship will pay out on the second death, it is safe to assume that survivorship will last longer, that the insurance company can collect premium longer, and would anticipate being able to keep the policy in force longer, aka not pay out quickly. Therefore, the premiums on joint or a little bit more expensive than on the premiums of survivorship.

Summary: Save money and simplify life insurance for couples by averaging their ages.

Types of Policies

- Joint Life Insurance

- Payout: Occurs upon the first death.

- Best For: Families with younger children needing immediate financial support.

- Premium: Higher, due to quicker payout.

- Survivorship Life Insurance (Second to Die)

- Payout: Occurs after the second partner dies.

- Best For: Couples with grown children, focused on leaving an inheritance or covering estate taxes.

- Premium: Lower, as the policy lasts longer allowing for longer premium collection.

Cost Comparison

- Joint Life Insurance: More expensive due to earlier payout.

- Survivorship Life Insurance: Less expensive because of delayed payout and extended premium collection period.

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about L&H GOLD

Share the Post

Click to share the post to your network