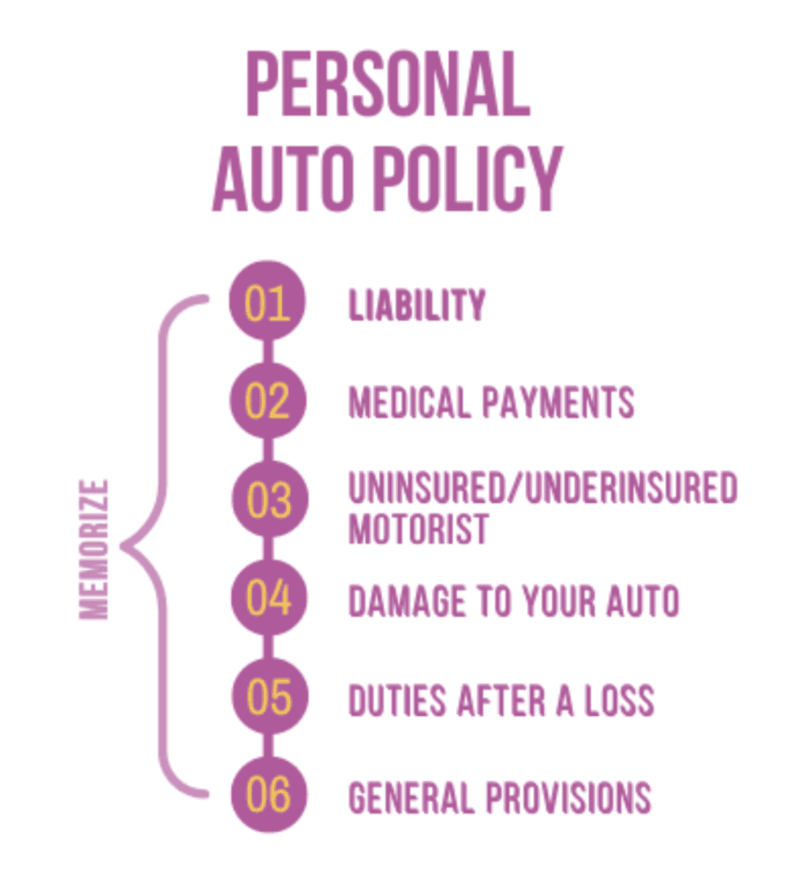

Personal Auto Policies

Quick Breakdown:

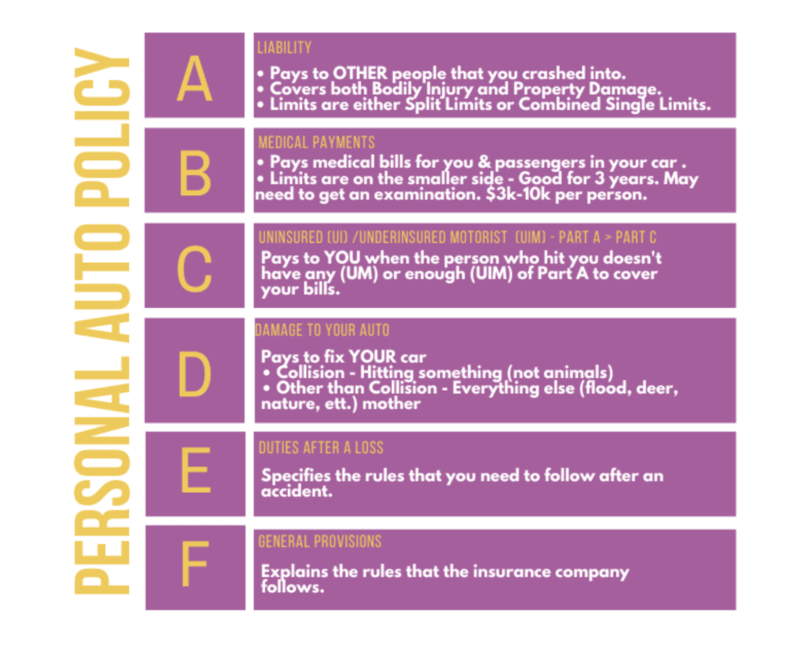

Part A: Liability – Pays to others that you injure in an accident. Limits are usually either split limits, or combined single limit.

Part B: Medical Payments – Pays to you and your passengers in your car for injuries that you have from an accident. This is usually a small limit, $3,000 to $10,000 per person.

Part C: Uninsured/Underinsured Motorist – Pays to you, when you are injured by somebody else, who either does not have any or enough insurance.

Part D: Damage to Your Auto – Pays to you, to get your car fixed or replaced.

Part E: Duties After a Loss – Specifies the rules that you need to follow after an accident.

Part F: Policy Provisions – Explains the rules that the insurance company follows.

Part A: Liability

Pays to others that you injure in an accident. Limits are usually either split limits, or combined single limit.

When you chose your car limits you can choose split limit which is most common or combined single limit.

Split limit looks like this 25/50/25. Which translates to:

$25,000 per person bodily injury/$50,000 total for bodily injury per occurrence/$25,000 per occurrence for property damage.

Basically, these limits are limiting how much one person can be paid for bodily injury in any one accident for both bodily injury and property damage.

For example, if you hit me in a car accident, and you carry 25/50/25, no matter how much my injuries are, the most I could collect would be $25,000 for my bodily injuries and $25,000 for my property damage to my car. Even if my injuries where $30,000, I can still only collect $25,000 because that is your limits.

Now, let’s say I had my daughter in the car, each of us can still only get up to $25,000 each and together with all our injuries added up, the most that would pay out for our bodily injuries are $50,000 total, again no more than $25,000 for each one of us. Even if my injuries were $10,000 and my daughters were $35,000, I would get $10,000 and she would get only $25,000. Technically you have $50,000 and between the two of us, our injuries are only $45,000, but since the limit is $25,000 per person, that’s all my daughter could collect.

Let’s say you hit me and my daughter and all her friends, the car is loaded with 5 people. Again your limits are 25/50/25. If all of us are injured at $10,000. None of us can get more than $25,000, so that’s fine, now we need to make sure we don’t exceed $50,000, which in this case we would exact hit $50,000 and all be paid for our medical bills. But, what if our injuries are $15,000 each? First, again, we make sure no one person gets more than $25,000. So that’s fine. Next, we issue out the money and stop at $50,000 because that’s all you have for any one accident. It would look like this:

- Me: $15,000

- Daughter: $15,000

- Friend 1: $15,000 (At this point, your policy has paid out $45,000, and you only get $50,000)

- Friend 2: $5,000 (because that all you have left)

- Friend 3: $0 (because there is nothing left of the $50,000)

Now, in the real world, technically we would all get something in proportion to our injuries, but in the test world, we pay out to each person up to the per person limit, and no more than the total per accident limit.

So what is combined single limit? This one is much easier, but it’s more expensive to the insured because the insurance companies will almost always pay more. Let’s look at the same examples but this time with a Combined single limit of $100,000.

In the first accident, the most I can get for myself and my car would be $100,000. There is no separate limit on bodily injury and property. So if my injuries are $30,000, I would get $30,000 and there would be $70,000 left for my car.

In the second scenario, you hit my daughter and I. if my injuries were $10,000, I would get $10,000 and my daughters were $35,000, she would get $35,000 and there would be $55,000 left for our car.

In the next example, were you hit five of us and we each had $10,000 in injuries, we would each get $10,000 and there would be $50,000 left for out car.

In the last example, you hit 5 of us and we each had injuries of $15,000. We would each get $15,000, which adds up to $75,000 and we would have $25,000 left for our car.

The difference in the two is, with combined single limit, the per person goes away and the difference between bodily injury and property damage goes away as well.

Now, no matter what, if I have Split limit or Combined single limit my policy will always have an aggregate as well. The rules of the aggregate are the same no matter what policy we have. Let’s say we have a 25/50/25 Limit of Liability, and keep in mind the 25/50/25 is my Per Occurrence limit, that’s all that will ever be available for any one accident on this policy.

Let’s say I have an accident at 9am, another at 10am, 11 am, etc, etc. Every accident I have my limit applies the 9am accident is 25/50/25, the 10am accident is 25/50/25, the 11am accident gets 25/50/25 and so on. HOWEVER, at some point, the insurance company will say ENOUGH!! We cannot pay out anymore! That “enough” is the aggregate. Usually the aggregate is like a million dollars. So every accident I have gets 25/50/25 and it’s pulling from a one million dollar bucket and once that bucket is empty I have no more money left for accidents. The bucket is usually replenished by each renewal, or every year, which ever the company sets up.

Remember:

- Per Occurrence is the most any one accident can pay out.

- Aggregate is the most anyone policy, with all accidents added up, will pay out.

Part B: Medical Payment

Unlike homeowners, medical payment is now for you and the passengers in your car.

Just like Homeowners though, it will pay out regardless of fault. So you can collect under medical payments whether you caused the accident, or the other person caused the accident. medical payments will also pay out if you are ever struck by a vehicle as a pedestrian.

Medical payments are generally a very small limit usually $3,000 to $10,000. It pays out per person, per accident.

One of the requirements, for medical payments is that you must submit a doctor bill. This is not money available for pain and suffering or mental anguish, there must be a direct medical cost in order to collect under medical payments.

Just like Homeowners, you have up to three years from the date of the accident to submit a claim.

Part C: Uninsured/Underinsured Motorist

Pays to you, when you are injured by somebody else, who either does not have any or enough insurance.

While the definition is much bigger:

- Uninsured Motorist (UM) is for when the person who hit you has NO insurance.

- Underinsured (UIM) is when the person who hits you doesn’t have ENOUGH insurance.

When you select Part C, you normally pick the same limit for both UM/UIM, however, they do not pay out the same at all.

When you are in an accident with someone has NO insurance, the only policy you have to collect on is your own Part C, so you are allowed up to the full per person amount. Let’s say you carry 50/100. You’re in a hit and run, and you will get up to $50k.

Now, what happens if you’re hit by someone who doesn’t have ENOUGH insurance? Let’s say your injuries are $100K, and you are hit by somebody who is carrying Part A of 50/100K. And you still have your Part C 50/100.

So the other person will pay you the full limit of their 50K, knocking your doctor bill from 100K to 50K. Now, you call your insurance, and hoping to get all of your 50K to finishing paying the bill, but you won’t. What they will do is say, “Ok, you have 50K Part C, you already collected $50K, so 50K minus 50K, is ZERO dollars that we can give you.”

Your insurance company will ALWAYS subtract what you have collected from the other person to your limit and only give you the difference.

So let’s look at a question on the practice test:

Alan has a Personal Auto Policy with Part C Limits of 100/300. Alan is injured by Ben who has Part A of 50/100. The police determine that Ben is responsible for the accident and Bens $125,000 injuries. How much will Alan’s Part C pay?

We begin by using all of Ben’s per person limit toward the bill to see what’s left to be paid, so it would be $125,000-$50,000=$75,000.

Now, we look at Alan’s Part C Per person limit, minus what he got from Ben, so it’s $100,000-$50,000=$50,000. Since he still owes $75,000, he can get all that’s left, which is $50,000, he will still need an additional $25,000 but he won’t be getting it from either policy.

Remember to make sure you’re looking at the right thing, Per Person, or Per Occurrence, it will depend on the question they asked.

Part D: Damage to Your Auto

Pays to you, to get your car fixed or replaced.

There are two separate coverages under Part D and you can either have just other than collision, or you can have both other than collision and comprehensive. You are not able to get collision without first having other

than collision.

Other than collision, will pay out for things that are generally not under your control. This would include fire, theft, mother nature, and even animals.

Collision, usually will pay out for things that are within your control. Anytime you hit something it is considered collision, whether you hit another car, a guardrail, a tree, it’s all collision. The only time that you hit something that it is not considered collision is when the thing you hit is an animal. Hitting an animal will pay out under other than collision.

- Collision is something the car DOES.

- Comprehensive is something that HAPPENS to the car.

If a commercial sign falls on an auto, is this considered collision or other than collision?

A sign fell ON the car, it HAPPENED to the car, this is comprehensive.

If a parked car rolls down a hill without anyone in it, is this considered collision or other than collision?

The car ROLLED, this is a collision.

If you are driving at high speeds and your car flips over, is this collision or other than collision damage?

The car FLIPS, this is a collision.

For either of these coverages, you select a deductible. The higher the deductible, the cheaper the premium.

After an accident, the insurance company will assess the vehicle, and will determine if they’re either going to repair the car, or replace the car/pay you the value of the car. It is always the insurance companies choice.

If they decide to replace your car/pay out for it, they’re going to come up with a value that your car is worth, using the ACV method( replacement cost, minus wear and tear). If you disagree with them about the dollar amount they come up with, you can get an appraiser, a third-party person, to come in and help determine the value of the vehicle.

Part E: Duties After a Loss

Specifies the rules that you need to follow after an accident.

This section specifies the things that the insured is supposed to do after an accident. it is not necessary to memorize this list, but to think of common sense things that you should do after an accident. You should cooperate with the insurance company, allow them to examine the damage property, etc. The the two things I do recommend that you memorize, is that you always need to have a police report if you are going to submit a hit and run accident, or a theft.

Part F: Policy Provisions

Explains the rules that the insurance company follows.

I don’t think it’s important for you to memorize every policy provision.

Most of these, you have already learned as a definition. For instance one of the policy provisions is subrogation, that the insurance company if they pay out for an accident that is not your fault, they can go after the person who is at fault.

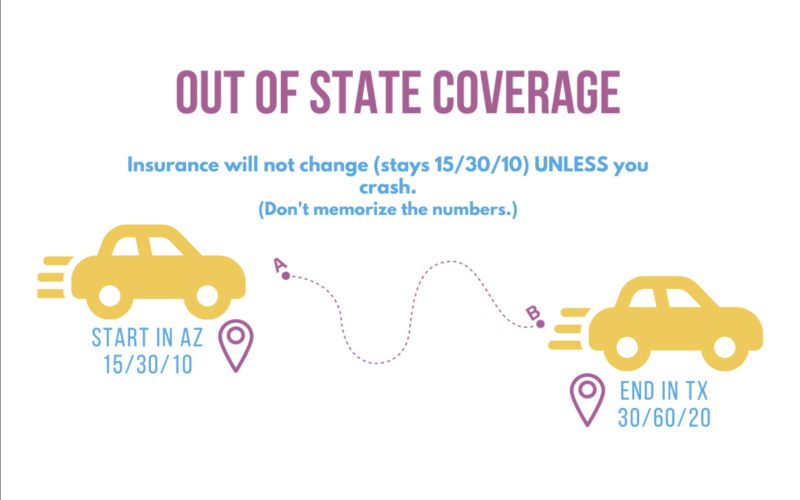

Out of State Coverage Auto

Every state gets to pick how they do insurance. In Arizona for instance, the minimum requirements are that you carry $15,000 per person for bodily injury, $30,000 total for all bodily injury, and $10,000 for property damage(15/30/10). In the state of Mississippi, they have limits of $25,000 per person for bodily injury, $50,000 total for all bodily injury, and $25,000 for property damage(25/50/25). So what happens if I am in my Arizona insured vehicle, and I drive to the state of Mississippi to visit my friends? The rule on auto insurance policies says that as long as I carried the minimum that my state-required, if I get into an auto accident in a different state with higher limits, my auto insurance will automatically bump up to that higher minimum if I were to have an accident.

Essentially, as I’m driving around Mississippi in my Arizona insured car, my coverage is still 15/30/10. But, if I crash into somebody in Mississippi, my coverage would now become 25/50/25.

Now, let’s say I have a Mississippi insured vehicle, which means I’m insured at 25/50/25. I drive to Arizona, and get into an accident. Which amount of coverage will I have? Well I have the Arizona State minimum, or my Mississippi State minimum? The answer is, I will always have whichever is higher. In this case I would keep my Mississippi minimums if I were to crash in Arizona because the minimums are higher than Arizona.

Shortest answer, when you drive out of state you’ll be able to take the highest coverage available. Whether your policy is higher, or the state that you’re driving in has higher limits, your insurance policy will pay out the highest of those two.

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about P&C GOLD

Share the Post

Click to share the post to your network