Property Policies

The primary purpose of property policies is to pay for losses after a peril (fire, hail, etc.) occurs and causes direct damage to the property.

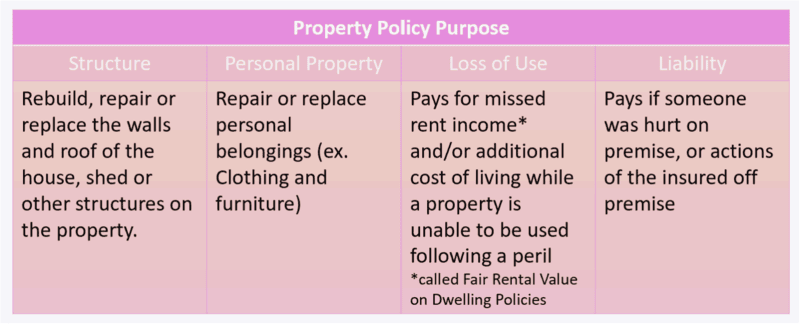

There are 4 main components/concerns to consider when your purchase a property policy: Structure, Personal Property, Loss of Use, and Liability.

Depending on the type of property (house, rental property, commercial building, etc.) and how it’s used (residential or business) will determine which components the insurance company will allow in the policy. Before we jump into that, let’s look at what the property can be protected from.

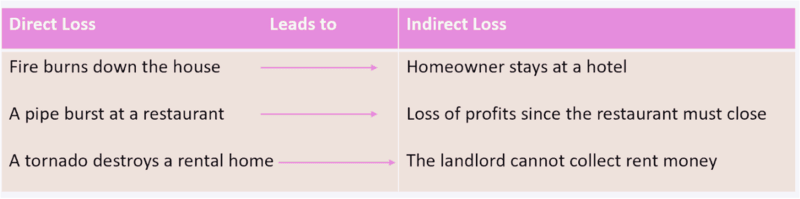

There are two types of losses that a property owner can be exposed to: Direct Losses and Indirect Losses.

Direct losses are ones that cause direct physical damage to the property. Indirect losses are the things that happen because of the direct loss.

An indirect loss is only covered if the Direct Loss is covered. For instance, flood is always excluded. If a home was destroyed due to a flood, the homeowners policy will not pay for a the additional living expenses of staying at a hotel.

Indirect losses are sometimes called consequential losses and are usually about time or money.

Direct losses also include proximate causes of loss. Proximate losses are damage that occurs separately, but next to, close to the direct loss. The most common proximate loss is wet walls/furniture that are a result of the fire department trying to put out a fire.

Let’s expand upon this:

- Fire is a peril that is covered on all property policies.

- Outside water coming into the property is a peril that is always excluded.

When a fire occurs at a house, fire trucks come out and spray the house down with water to put out the fire. When this happens, it is likely that there are things that will get wet even if they were not on fire. The things that got wet, only got wet because there was a fire. As mentioned above, outside water coming in is not covered. However, all the wet items and walls will be covered in this instance. Why? because the direct peril was fire, which is covered, and the water was only introduced into the house because of the fire. Therefore, both the fire and the wet things are all covered under the peril of fire. We call all the wet things, “proximate cause of loss.”

The word proximate, is like proximity, which means close to. The wet things are close to the fire, they are only wet because of the fire, so they will be covered under the peril of fire. Proximate losses are thus considered as part of the direct loss.

Indirect losses are usually time and money. If the house burns down, you need to go to a hotel to sleep. The extra cost of staying at a hotel is an indirect loss to the fire. You never would have stayed at the hotel if the house was still standing. The only reason that you’re going to a hotel is because the house burns down. Since fire is a covered peril, the cost of going to a hotel can be covered under indirect losses.

One way to think about it is the direct and proximate losses are the “danger zone.” A fire is burning, lighting is striking, hail is hitting, etc. The indirect losses are the things that happen after the danger moment has passed, it’s the aftermath of the peril. The fire is out, the lighting and hail stopped, and we say, “what now?” Now we need a hotel, now we are missing out on using the house, etc.

Not all direct losses are covered. In order to know which losses are covered or not, we need to learn about Perils.

Insurance companies will protect properties in one of two ways: Named Peril or Open Peril.

A peril is the CAUSE of loss, the events that happen, that lead to the destruction of property/bodily injury like a fire or accidental injury. Perils are the things you either are or are not covered for.

For property insurance, you can either purchase a “named peril” policy or an “open peril” policy.

A named peril policy says “only this is covered.” It’s a policy with a list of perils that you are covered for. Essentially, in order for the peril to be covered, it must be named/listed on the policy.

A named peril policy is offered at different levels-Basic or Broad. As the name implies, basic covers the basics and broad is a lot broader, covering more perils than the basics.

An open peril policy says, “anything BUT this is covered.” It’s the opposite of a name peril policy. Instead of saying what is covered, it says what is not covered. Everything is covered unless it’s excluded. An open peril policy is referred to as an “all risk” policy since it will cover all risks not excluded.

An open peril policy is easy, because it’s almost like a one size fits all. It covers everything not excluded, so they name open peril policies as Special and Comprehensive.

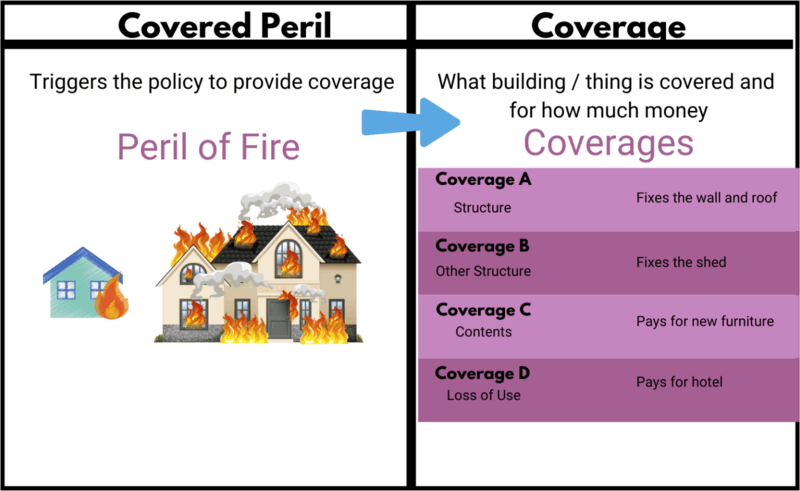

Keep in mind, there is a difference between a “covered peril” and “coverage.”

A covered peril is what triggers a policy to provide coverage.

Fire, which is always covered, would trigger the policy to provide coverage. The peril of flood, which is always excluded, would NOT trigger the policy to provide coverage.

Coverages describe two things-what building/thing is covered and for how much money.

Property policies generally have the same coverages-it’s the perils that are covered that makes policies different from each other.

Polices further break down coverages into “Major Coverages” and “Additional/Supplementary Coverages.”

The main coverages are easily identified because they are listed as letters- Coverage A, Coverage B, etc.

Additional or supplementary coverages are seen as extensions to the major coverages. They complement the major coverages and are built into the premium. Although we call them “additional,” there is no additional premium needed. Think of the additional coverages as the plate at a restaurant. You need the plate to get the food, but you’re not paying for the plate itself, it’s built into the cost of the food.

Additional coverages will be discussed in depth later, but one example for additional coverages is Lawn, Trees, Shrub or Plants. Not every home has lawn, trees, shrubs or plants, but all polices come with it.

Now that we have the foundation down for:

- The purpose of a property policy.

- The 4 main components/concerns.

- An understanding of named and open perils.

- And Major vs Additional Coverages.

It’s time to apply this knowledge to Dwelling and Homeowners Policies. Both polices cover houses/residential properties as opposed to commercial/business properties.

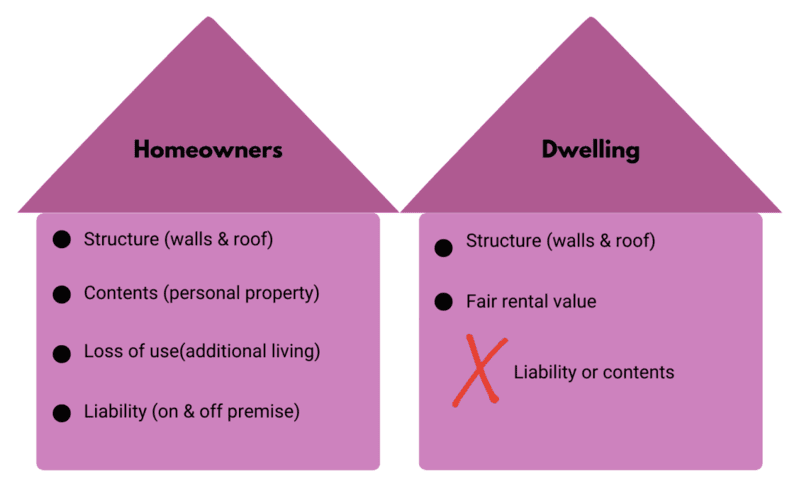

While there are many differences between Dwelling and Homeowners, the ultimate key difference is whether the house is “owner occupied.”

Owner occupied means the owner of the house/policy also resides in the house. This is a big deal to insurance companies because there is a significant difference in how well the house is kept up and maintained (how many claims are filed) when the owner lives there vs tenants living there.

Homeowners polices come with the requirement that the house is owner occupied.

Dwelling policies do not care whether or not the owner lives there.

Since a Homeowners policy requires the owner to live there, it will cover all 4 main concerns: Structure (walls & roof), personal property, loss of use and owner liability.

Dwelling policies on the other hand, only come standard with Structure (walls & roof) and loss of use. However, both personal property and liability can be purchased for a Dwelling policy for additional premium.

Let’s deep dive into Dwelling policies before we move on to Homeowners.

Dwelling policies are typically purchased by Landlords, people who own properties and rent the properties out to other people(tenants) to live in. Landlords primarily only care about the walls & roof, and the loss of rental income if they cannot rent the house following a peril.

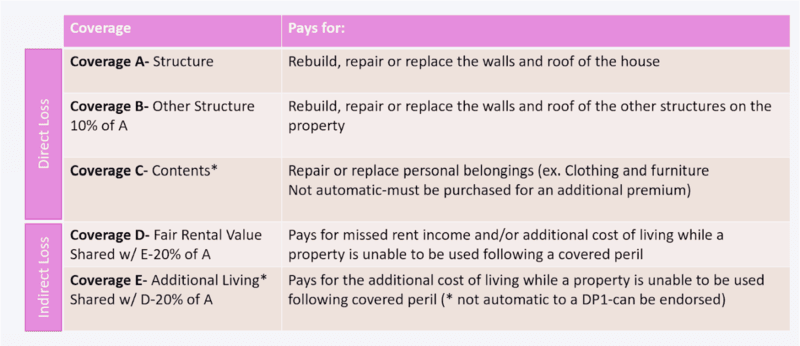

Let’s review the coverages available on Dwelling Policies.

Coverage A pays to repair, rebuild, or replace the walls and roof of the building/structure. The amount of money for this coverage is based on the rebuild cost of the individual house. For instance, a 3-bedroom, 2-bathroom house might be covered for $220,000 whereas a 5-bedroom, 4-bathroom house might for covered for $450,000. The amount of money is usually set by the insurer, based on the features of the home.

While walls & roof are the main definition of Coverage A, it also will pay out for covered perils for anything next to the property that will become part of the property. For example, if you have a pallet of roof tiles delivered to your house and set on your lawn until the roof repairmen come, the pallet would fall under the definition of A and be covered in the same way the house is. One more definition of A is anything used to service the property-such a lawnmower.

Coverage A is seen as the “Main Coverage” and once the value for Coverage A is established, the rest of the coverages become a percentage of A.

Coverage B pays to repair, rebuild, or replace other structures on the property that are not the main house or attached to the main house. This could be a detached garage, a shed, gazebo, etc.

Coverage B comes at a standard of 10% of Coverage A.

Coverage C pays to repair or replace personal property. This would be clothes, shoes, furniture, pots, pans. etc. It’s important to know that on Dwelling Polices, Coverage C is not automatically covered-it must be purchased for an additional premium.

If Coverage C is added to a dwelling policy, it’s a flat amount the owner chooses, like $10,000 and is not a percentage of Coverage A.

Coverage D pays out the fair rental value of a property to the owner if the property is uninhabitable following a covered peril. If the house burns down forcing the tenants to leave, the landlord cannot collect rent money. While the house is being repaired, the policy will pay the owner the fair rental value of the property until the repairs are done and or the money available runs out.

Coverage E pays the owner for additional living expenses if the property is uninhabitable following a covered peril. This only kicks in if the owner lives there and will stop until the repairs are done and or the money available runs out. On a DP1 only, this is not included, but it can be endorsed.

Coverage D and E, together get 20% of Coverage A. However the money is used between D and E, it’s capped out at 20% of Coverage A.

Dwelling polices come with all these coverages unless indicated.

Dwelling policies are not based on the Coverages since they all come with the same coverages. What makes the polices different is what perils will trigger the coverage to kick in. There are three types of Dwelling Policies-Basic, Broad and Special.

In order to help understand the policies, we can use a coffee example:

- A basic policy is black coffee.

- A broad policy is coffee with cream, sugar, and whip.

- A special policy is a mocha frappe with whip.

From this comparison alone, we can make some assumptions:

- Basic is the cheapest, bare bones, simplest policy (minimal).

- Broad is a better than basic (mean/average).

- Special is the fancy policy with all the extra (max).

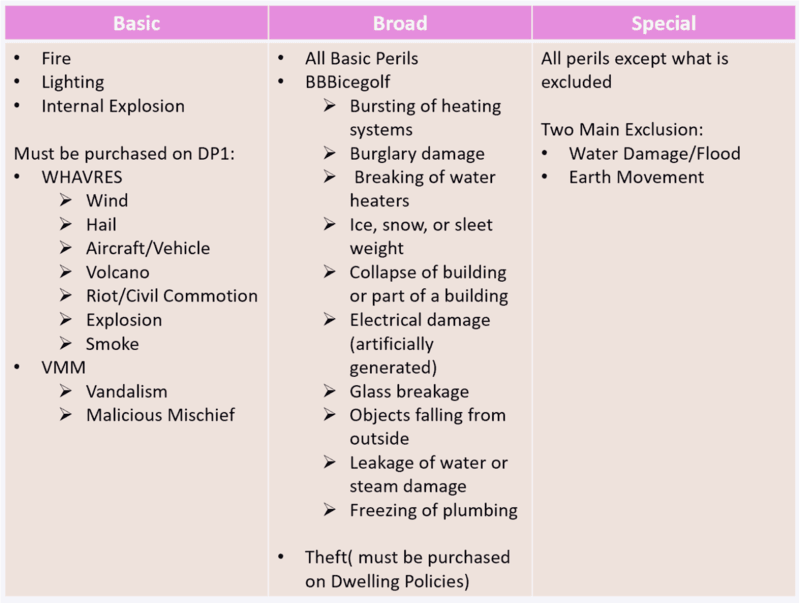

A Basic Dwelling policy is known as a DP1. The DP1 comes with only three named perils that will trigger the coverage to pay out.

The three covered perils on the DP1 are:

- Fire

- Lighting

- Internal Explosion

Since the DP is so basics, the insurance companies do have the ability to make it better. Like a black coffee drinker who prefers at least a splash of cream.

There are two package options that an owner can purchase are ECP or ECP+VMM.

ECP means Extended Coverages Perils. It’s a package of perils that you can add to the three already covered. To help us memorize which perils are part of the Extended Coverage Perils we use the acronym of WHARVES which stands for:

- Wind

- Hail

- Aircraft/Vehicles

- Riot/Civil Commotion

- Volcanic Eruption

- Explosion (expands from internal to all)

- Smoke

If the owner has purchased ECP, they can they also purchase VMM, Vandalism and Malicious Mischief. It’s important to note that cannot just buy VMM, they must buy ECP first.

All the perils that are available to get on the DP1 are known as the basic perils.

A couple things that are unique to a DP1:

- The payout following a claim is based on ACV for everything.

- Trees are not covered on DP1.

- Coverage E must be endorsed on the DP1 if the owner wants it.

- Coverage B must come out the value of A, it’s not an additional 10% on top of A

A Broad Dwelling policy is known as DP2. The DP2 comes automatically with ALL the basic perils, plus the perils known as BBB-Ice golf.

Trees on the Broad Policy and Special Policy are covered at $500 per tree.

A Special Policy is known as DP3. The DP3 covers everything the DP1 and DP2 does, plus any other perils that happen unless it’s excluded.

Since a DP3 is open perils it does cover theft-for Coverage A and B. Meaning, the theft of property that is next to house that will become part of the house(ex. pallet of roof tiles) or things used to service the property(ex. Lawnmower).

Speaking of the pallet of roof tiles, on any of the dwelling policies, the pallet of roof tiles would be covered for fire since fire is always a covered peril. If the pallet of roof tiles is stolen, only the DP3 would provide coverage. Same for the lawnmower since it also fits the definition of A. If the lawn mower is stolen, only the DP3 would pay out. If the lawnmower was burned in a fire, all the policies would pay out under Coverage A.

Since DP3 is open perils, it will have a much larger exclusion list. However, also keep in the mind the two main exclusions on all policies- water damage/flood and Earth Movement.

Let’s recap the dwelling policies:

- Dwelling policies can be owner or tenant occupied. The main coverage is for the walls & roof of a residential property as well as the fair rental value of the property. More coverages, like contents or liability can be added as needed for additional premium.

- DP1 is known as basic, and it covers the basic perils. Fire, lightening, and internal explosion are covered automatically, but for additional premium the ECP can be added to expand the perils to include WHARVES and for even more premium VMM can be added as well.

- DP2 is known as Broad. It covers all the basic perils automatically and expands the perils to include BBBicegolf.

- DP3 is known as Special, it covers all the basic and broad perils plus any other peril not excluded.

Now that we understand Dwelling, we will move on to Homeowners.

As we already established Homeowners policies require that the policy owner occupies the house. This means that in order to get the Homeowners policy, they must live at the property that they want to insure. This also means that all Homeowners Policies come with Contents Coverage, known as Coverage C and Liability which is Coverage E.

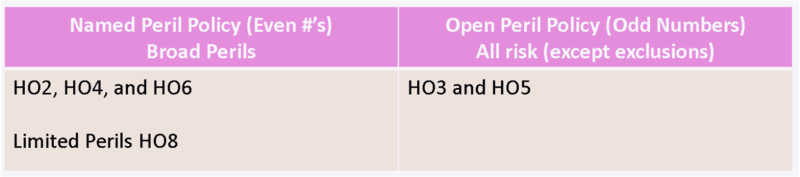

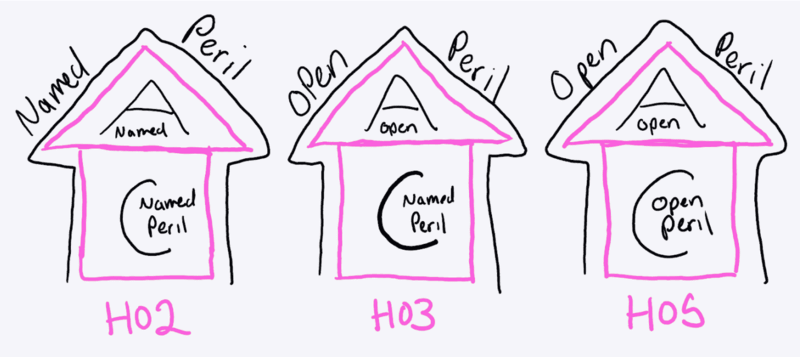

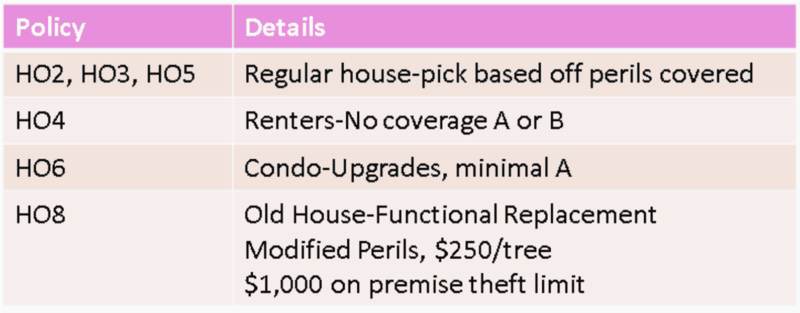

With Dwelling policies, the main difference was the perils that were covered. For homeowners, the policies are categorized not just by perils but the type of residence. First, let’s look at the perils. All Even numbered policies are Named Peril, specifically Broad Perils. The only exception is H08 which has limited perils and that will be discussed later.

All odd numbered Homeowners policies are open peril policies which cover everything not excluded.

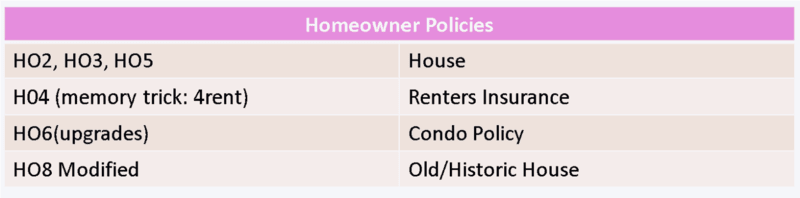

If the insured has a regular house, they can choose between and HO2, HO3 or and HO5. Which one they choose would be based on which perils they want covered for the structure and the contents inside.

HO2 will cover all the Broad form Perils for both the structure (Coverage A) and the contents (Coverage C).

HO3 will cover the structure (Coverage A) under Open Perils, and the contents (Coverage C) will be covered under named perils.

HO5 will cover the structure (Coverage A) and the contents (Coverage C) under open perils.

A HO4 Policy is for a renter. This is a unique policy since the renter doesn’t care about the walls or roof. This means that the H04 does not have Coverage A or B, it doesn’t need it.

A HO6 Policy is for a Condo Owner. This is a unique policy because the walls and roof will be rebuilt by the condo association to a basic model. This means that the HO6 policy will only cover the costs of upgrades to the house-the difference in cost between the basic model and the upgraded material. For example, the condo association will pay for laminate countertops, and the HO6 policy would provide the additional money to upgrade the countertops to granite.

One other unique feature about an HO6 is that if you need coverage for other structures, instead of Coverage B, the insured just adds the amount they need into Coverage A. For example, if a policy needs $2,000 for upgrades to the countertops and the condo owner hold owns a shed in the back yard valued at $5,000, then Coverage A would be listed for $7,000.

A HO8 policy is known as a Modified Policy. This policy is for older house where the market value(what it can be sold for) is less than rebuild value(what it would cost to rebuild the house). Usually the reason that the rebuild is so high is due to the outdated or historic characteristics of the house, like plaster walls. In modern times, we us dry wall which is less expensive to repair or replace then plaster. This is also why HO8’s use functional replacement which says that replacement cost will be based on using the modern less expensive construction material.

A few other things they modified on the HO8 is the perils. Instead of all the Broad form perils, HO8 only really covers the basic perils and theft. However, theft is limited to $1,000 for on premise theft only for a HO8. Another modification is that trees on an HO8 are limited to $250 for trees.

Coverages on Homeowners Policies are a bit different then on Dwelling. Coverage A, B and C are the same:

- Coverage A pays to repair, rebuild, or replace the walls and roof of the building/structure. The amount of money for this coverage is based on the rebuild cost of the individual house. For instance, a 3- bedroom, 2-bathroom house might be covered for $220,000 whereas a 5-bedroom, 4-bathroom house might for covered for $450,000. The amount of money is usually set by the insurer, based on the features of the home.While walls & roof are the main definition of Coverage A, it also will pay out for covered perils for anything next to the property that will become part of the property. For example, if you have a pallet of roof tiles delivered to your house and set on your lawn until the roof repairmen come, the pallet would fall under the definition of A and be covered in the same way the house is. One more definition of A is anything used to service the property-such a lawnmower.

Coverage A is seen as the “Main Coverage” and once the value for Coverage A is established, the rest of the coverages become a percentage of A. - Coverage B pays to repair, rebuild, or replace other structures on the property that are not the main house or attached to the main house. This could be a detached garage, a shed, gazebo, etc.Coverage B comes at a standard of 10% of Coverage A.

- Coverage C pays to repair or replace personal property. This would be clothes, shoes, furniture, pots, pans. etc.

Coverage C is comes standard at 50% of Coverage A.

Now the remaining coverages have some changes compared to Dwelling policies. - On a Dwelling, Coverage D was known as Fair Rental Value and Coverage E is additional living. On a homeowner’s policy, the still have coverage for both Fair Rental Value and Additional living, but they group them together as Loss of Use.

Coverage D on homeowners is called Loss of Use and combines fair rental value and additional living. Coverage D would pay out the fair rental value of a property to the owner if the property is uninhabitable following a covered peril. If the house burns down forcing the tenants to leave, the homeowner cannot collect rent money. While the house is being repaired, the policy will pay the owner the fair rental value of the property until the repairs are done and or the money available runs out. Coverage D also pays the owner for additional living expenses if the property is uninhabitable following a covered peril. On a homeowners, Coverage D will pay until the repairs are done and/or the money available runs out.

Coverage D comes standard at 30% of Coverage A. - Coverage E on a Homeowners is liability coverage. This covers the activities of the named insured if they accidently cause injury or damage to other people. For example, a dog bites a guest and they need medical attention, the homeowners policy of the dog owner can pay the medical bills. It’s important to note this coverage is for other people, the homeowner and their family cannot receive payouts under this, but it does pay out for their actions.

The amount of coverage for this is a flat dollar amount starting at $100,000 and can be raised if the homeowner wants more coverage

- Coverage F on a Homeowners is for Medical Payments sometimes abbreviated as Med Pay. This is money that is available for medical payments to people who were injured, but without fault. I like to call this a “good neighbor” coverage-“It’s not my fault you got hurt, but since it was at/near my house, here is some money for your medical bills” And there must be actual medical bills for this to pay out. Additionally, the insurer may request that the person collecting under Med Pay submit to a physical exam by a doctor as often as reasonably necessary.

Co-Insurance P&C

The whole goal of getting insurance on a house/building is to be able to rebuild it completely if it were to burn down(or whatever other peril is covered). So, if the insurance needs to rebuild the house from the ground up, they really need to make sure they have adequate funds to do that, right? This is called Insurance to Value. Insure the house for the amount of money you would need to replace it.

Let’s say Bob has a home he wants to insure. Bob is a contractor and he feels that if anything were to happen to his house, he can do the repairs or rebuild for a cheaper price than what the insurance would have to pay. Thus, when the insurance company tells Bob that Coverage A needs to be $100,000( the money needed to rebuild it from the ground up), he says he wants less coverage than that(the lower coverage A, the cheaper the premium).

At this point, the insurance company will ask him to at least cover the house to 80% of the amount they estimated, and if he does cover it for at least 80% they will cover partial losses to the full amount (Replacement Cost). They tell him if he covers the house for less than 80% of the value they estimated for Coverage A, when he does have a partial claim(partial means a claim less than the whole house needing fixed), they will NOT cover the total cost of the claim, and they will also pay out actual cash value instead of replacement cost. This is the insurance companies way of saying “if you’re going to be cheap, we will be cheap on partial claims.”

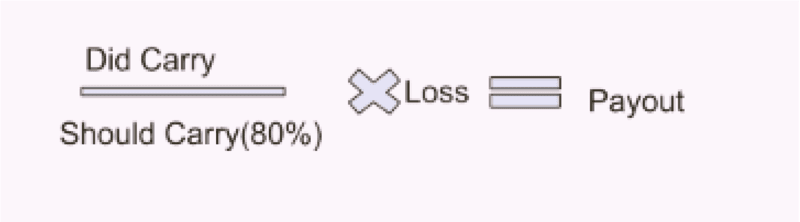

Bob, as a contractor, knows he can still repair the house even if they don’t give him the total money needed on a partial claim, and he doesn’t want to pay the premium for $100,000 or even $80,000 (80% of $100,000), and he would rather cover the house for $50,000. The insurance company will let him, but when a claim comes in, they are going to use the co-insurance equation to figure out what they will pay. The equation is, What he did carry, divided by what he should of carried(80%) multiplied by the loss, and what that equals to will be the claim payout.

A month later, Bob has a kitchen fire and the damage is estimated at $5,000. And now they are going to use the co-insurance equation to figure out what they will actually pay of the $5,000. So, it will look like this:

50,000 / 80,000 x 5,000 = $3,125.

The insurance will only send him a check for $3,125, instead of the full $5,000 needed for repairs, he was cheap, they will be cheap.

So, co-insurance is an insurance companies way of trying to get people to carry an adequate amount, and lessening their burden of claim payout when the insured doesn’t carry at least 80%.

Now, if the whole house burned down and it was considered a total loss, the insurance would give him the full $50,000. Co-insurance equation only kicks in on partial losses(anything less than the total house being burned down).

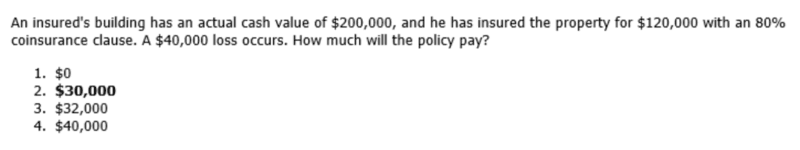

Let’s look at a Co-Insurance Question in the course, and break it down:

The answer is $30,000. Why?

The house has a value of $200,000. In order to satisfy the co-insurance requirement, the owners needs to carry at least 80% of that value.

80% of 200,000 is 160,000.

Since he is only carrying $120,000, we know that he is NOT within the minimum required and if a claim were to occur, the Insurance company will use the Co-insurance equation to figure out how much they will pay.

The claim is $40,000, so let’s set up our equation.

He DID carry $120,000. He SHOULD have carried at a minimum $160,000 and the loss was $40,000.

120,000 / 160,000 = .75 x 40,000 = 30,000

The insurance will only pay $30,000 for the $40,000 loss.

Usually for the test, they are either going to ask you what is the 80% or what will the claims pay out be.

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about P&C GOLD

Share the Post

Click to share the post to your network